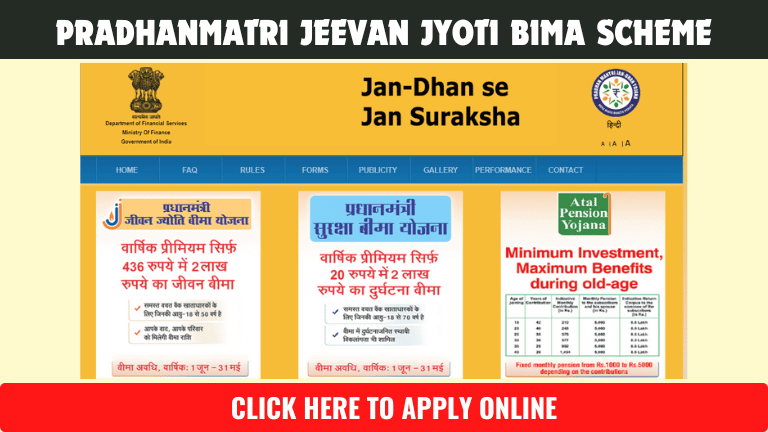

PMJJBY, or Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhanmatri Jeevan Jyoti Bima Scheme is a scheme that provides death benefit. PMJJBY and PMSBY will have been providing social security for May 2022. This program covers low-income and vulnerable family groups and offers them financial support in the event that an insured person passes away, up until the family finds another source of income.

Contents

Pradhanmatri Jeevan Jyoti Bima Scheme 2023 (PMJJBY)

| Post Name | Pradhanmatri Jeevan Jyoti Bima Scheme (PMJJBY) |

| Category | Scheme |

| Portal | freshgujarat.com |

| Post Date | 06/12/2023 |

There are many schemes of the government which we are not aware of and we should take capital investment or life insurance which will be useful to our family during some later period of our life or after our death.

What is Pradhanmatri Jeevan Jyoti Bima Scheme (PMJJBY)?

Those who are between the ages of 18 and 50, have bank accounts, and consent to participate in/activate auto-debit are eligible for the PMJJBY. The Pradhan Mantri Jeevan Jyoti Bima Yojana offers insurance exclusively in the event of death. As a result, only the nominee will receive the benefit. PMJJBY is a pure-term insurance policy; it has no investment component and only covers mortality. Aadhar would be the main Know Your Customer (KYC) for the bank account.

In India, the government-backed Pradhan Mantri Jeevan Jyoti Bima Yojana is a life insurance program. It was first brought up in February 2015 during the budget speech given by the late Arun Jaitley, who was the finance minister at the time. Prime Minister Narendra Modi formally introduced it in Kolkata on May 9.

Implementation of PMJJBY |

The Department of Financial Services, Ministry of Finance, Government of India, is where PMJJBY is housed. It is carried out by Life Insurance Corporation and other life insurance providers who are willing to provide the product under similar terms, in collaboration with banks, and after obtaining the necessary approvals.

Eligibility for PMJJBY |

Pradhanmatri Jeevan Jyoti Bima Scheme (PMJJBY) Eligibility criteria are listed below.

- PMJJBY Age Limit: Any person between 18-50 years of age who possesses a savings account can enroll in this scheme through the participating banks.

- People who enroll after the initial enrollment period, which is from August 31, 2015, or November 30, 2015, as applicable, will need to certify on their own behalf that they are in good health and do not have any of the critical illnesses listed in the relevant Consent cum Declaration form as of the enrollment date, whichever is earlier.

- Even if a person has many bank accounts, they can still participate in this program with only one savings account.

How to Apply Online PMJJBY | How to form Pradhan Mantri Jeevan Jyoti Bima Yojana ? |

Application for “ Pradhan Mantri Jeevan Jyoti Bima Yojana Form ” can be done at any nationalized bank. Where all the details have to be filled in the application form. In which the person’s name, address, mobile number etc. information has to be filled. All the documents have to be submitted to avail the benefit of this scheme. Such as doctor’s health certificate, bank passbook, passport size photo, Aadhaar card etc. have to be deposited.

Documents |

- Aadhar Card

- Bank Passbook

- Mobile number

- Another identity card

- Passport size photos

Features of PMJJBY |

- Renewal is Simple: The policy can be renewed annually and offers life insurance for a year.

Better Insurance Coverage: Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) policy offers 2 Lakh Rupees worth of life insurance for Rs. 330 in yearly premiums.

- No Maturity Benefits: Because the policy is a term insurance plan, it only provides coverage for life risks and does not permit the claim of maturity benefits.

- Mandatory Savings Bank account: The policyholder must have a savings bank account to use this plan, which can be purchased at any partner banks in India that have agreements with the LIC and other private insurance providers.

- Hassle-free Procedures: 45 days after enrollment, life insurance coverage becomes effective. However, in the event of a fatal accident, the total promised amount will be paid. The policyholder can easily rejoin the scheme even if they choose to leave it for whatever reason.

- PMJJBY Premium: The premium will be taken out of the account holder’s savings bank account via the “auto debit” feature on or before the 31st May of each annual coverage period under the scheme, depending on the option selected.

Benefits of PMJJBY |

- In case of the death of the insured, the nominee will receive a lump sum payment of Rs. 2 lakh.

- The premium for PMJJBY is Rs. 330 per year. This is a very affordable amount for most people.

- PMJJBY can be enrolled through any bank or post office. There is no need to undergo any medical examination.

- Once you have enrolled for PMJJBY, the premium will be auto-debited from your bank account every year.

- The premium paid for PMJJBY is eligible for a deduction under Section 80D of the Income Tax Act, 1961.

Here are some additional benefits of PMJJBY:

- You can transfer the policy to another bank or post office if you change your bank or location.

- You can choose to pay the premium annually, half-yearly, or quarterly.

- The money collected under PMJJBY is invested in government securities. This ensures that the money is safe and secure.

Important Link (Apply Online Pradhanmatri Jeevan Jyoti Bima Scheme (PMJJBY) ) |

Pradhan Mantri Jeevan Jyoti Bima Yojana pdf is made in prescribed format by the Ministry of Finance, Government of India. And the PDF file for Pradhan Mantri Jivan Jyoti Yojana Claim Form will be available through the following link.

| Application Form and Claim Form | Link |

|---|---|

| Pradhan Mantri Jeevan Jyoti Bima Yojana Form in English | Click Here |

| Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Form in English | Click Here |

| Pradhan Mantri Jeevan Jyoti Bima Yojana Form in Hindi | Click Here |

| Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Form in Hindi | Click Here |